Business Insurance

Broadform Liability

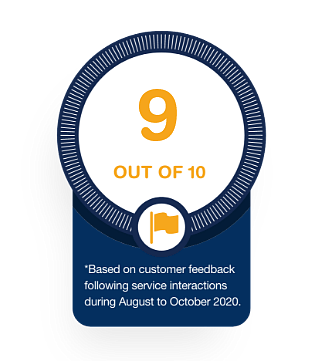

We asked our customers to rate us on how easy it was to deal with us. They did their thing and scored us 9.1*/10 on average.

Thank you

A qualified agent will contact you shortly for a Business Insurance quote for {{BusinessCallmeback.BusinessName}}

Broadform Liability

If your business is ever held legally responsible for third party claims, it can destroy everything you have built up. Do your thing and save ching before anything happens. Make sure you’re covered for incidents that occur at or away from your premises as well as for defective workmanship and product liability.

Who needs this cover?

All business owners whether you:

● have business premises frequented by third parties,

● frequent third party’s premises or

● produce, sell, store, alter, repair any products.

Why do you need this cover?

Broadform Liability insurance is there to protect your balance sheet. As a small business owner, this is essential to ensure the longevity of your business. Business owners can be held liable for:

● Third parties getting injured or having their property damaged at your premises. This could be a car damaged in your parking lot or a customer tripping over uneven paving on the way to the front door and suffering an injury

● Causing resultant damage to a third party’s property while working at their premises. For example, a plumber could cause a house to flood by not carrying out his work correctly.

What do we cover?

● General liability

○ Property Owners/Tenants Liability

○ Spread of Fire Liability

● Products Liability

○ Defective Workmanship

○ Product Inefficacy

● Sudden and Accidental Pollution Liability

● Other Extensions

○ Employers’ Liability

○ Gratuitous negligent advice

○ Statutory Legal Defence Costs

○ Wrongful Arrest

○ Defamation

What we don’t cover:

● The re-do/repair/replacement of your supplied product and/or work.

● Damage to the part of the property that you were working on.

● Liability arising from an event or circumstance that occurred prior to the retroactive date.

● Liability arising from communicable diseases.

● Cyber Liability.

Tailor-made Insurance

You understand your business better than anyone and we understand insurance, so together we can create and customise the perfect business insurance solution with your specific business needs in mind.

Biz Assist Benefit

We automatically include Biz Assist with your cover, giving you 24/7 online and telephonic support.

Specialised cover

We provide commercial insurance to a number of specialised industries, including e-hailing, tradesman, and business professionals.

All businesses welcome

We cater to hundreds of business types, tailor making every business insurance solution with each of their business needs in mind.

Frequently Asked Questions

How long is the waiting period for Business Insurance?

Test Answer

How long before I get my pay-out after claiming?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Can I insure more than one business?

Test

Am I allowed to upgrade or downgrade my cover?

Test

Tailored Insurance Solutions

We have a customizable insurance option that can suit almost any type of business

Business Property Insurance

We’ll protect your building or premises against any natural disasters, threats or weather conditions.

Bed & Breakfast

We’ll cover your Bed and Breakfast business so you can focus on giving your clients the best experience.