Business Insurance

Directors and Officers Liability

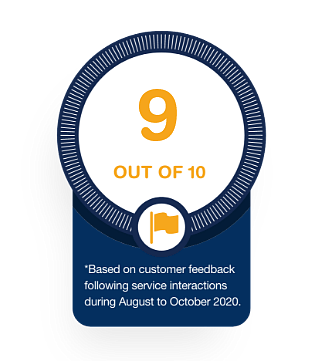

We asked our customers to rate us on how easy it was to deal with us. They did their thing and scored us 9.1*/10 on average.

Thank you

A qualified agent will contact you shortly for a Business Insurance quote for {{BusinessCallmeback.BusinessName}}

Directors and Officers Liability

As a director, prescribed officer or senior manager, your actions and decisions can result in a loss for your company or a stakeholder. As you can be personally held liable for this, the legal costs can be really high, plus your personal assets like your pension fund are at risk. To make sure that you can still do your thing and earn your ching, Directors and Officers Liability insurance has you covered.

Who needs this cover?

Individuals or companies who give professional advice. These professionals usually hold qualifications in their area of expertise and include:

● A member of a company board, whether executive or non-executive

●An alternate director of a board

● Any person who acts as a director, even if not officially appointed

● Prescribed Officers

● Senior Management

● Employees who serve on committees

● Any person who sits in a management role.

Why do you need this cover?

The Companies Act imposes personal liability for a breach of fiduciary duty. When you accept your appointment as a director, you take on a fiduciary duty in respect of the company. Anything that you say or do must be in the best interests of the company, and with any business you undertake on the company’s behalf.

We don’t cover:

- Liability arising from a breach of contract unless it is a breach or alleged breach of professional services provided by you.

- Liability arising out of any deliberate, willful, dishonest, fraudulent, criminal or malicious act or omission committed by you or on your behalf.

- We don’t cover the cost of rectifying your work.

Tailor-made Insurance

You understand your business better than anyone and we understand insurance, so together we can create and customise the perfect business insurance solution with your specific business needs in mind.

Biz Assist Benefit

We automatically include Biz Assist with your cover, giving you 24/7 online and telephonic support.

Specialised cover

We provide commercial insurance to a number of specialised industries, including e-hailing, tradesman, and business professionals.

All businesses welcome

We cater to hundreds of business types, tailor making every business insurance solution with each of their business needs in mind.

Frequently Asked Questions

How long is the waiting period for Business Insurance?

Test Answer

How long before I get my pay-out after claiming?

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Can I insure more than one business?

Test

Am I allowed to upgrade or downgrade my cover?

Test

Tailored Insurance Solutions

We have a customizable insurance option that can suit almost any type of business

Business Property Insurance

We’ll protect your building or premises against any natural disasters, threats or weather conditions.

Bed & Breakfast

We’ll cover your Bed and Breakfast business so you can focus on giving your clients the best experience.